My ancestors were full-blooded Indians … until the census said otherwise

Voices of West Tampa: District 5 Special Election Forum, Aug. 27th

From Illinois to Texas, CTU President Stacy Davis Gates Leads Largest African American Parade in the Country Amid National Education and Democracy Attacks

The Rebirth of BlackUSA.News

Politics26: Where Real Talk Meets Real Change :: LIVE Wednesdays at 6pm

Ever Heard of Atlanta’s Russell Innovation Center for Entrepreneurs (RICE)?

BEO Profile: Tulsa Mayor Monroe Nichols, IV

Why the Sydney Sweeney “Great Jean(s)” Ad Sparks Accusations of Racial, Eugenic Messaging

Mandy Bowman and the Rise of Black Women in Business: A Testament to Tenacity and Transformation

🏈 MEAC/SWAC Kickoff 2025: North Carolina Central Eagles vs Southern Jaguars

Lincoln University Football Media Day 2025 | HBCU Original x Runway to Purpose x Under Recruited

N.C. A&T Alumnus Named 2025 Wells Fargo N.C. Principal of the Year

2025 HBCU Homecoming Games: The Ultimate Football Celebration by Conference! Howard vs. Morgan, Oct. 25th

NC A&T Students Bring Artistic Vision to National Stage Through HBCU Art Exchange

Secretary-General Gravely Alarmed by Israel’s Decision to Take Control of Gaza City

Security Council Press Statement on Situation in Democratic Republic of Congo

One God. One Aim. One Destiny: Africa’s Past, Present, and Future

Africa Exploratory Trade Mission to Morocco & Ghana, October 24, 2025 – November 1, 2025

South Africa, Sanctions, and the Politics of Global Punishment

Published

4 years agoon

For years, Democrats and even some Republicans such as former President Donald J. Trump have called for closing the so-called carried interest loophole that allows wealthy hedge fund managers and private equity executives to pay lower tax rates than entry-level employees.

Those efforts have always failed to make a big dent in the loophole — and the latest proposal to do so also faltered this week. Senate leaders announced on Thursday that they had agreed to drop a modest change to the tax provision in order to secure the vote of Senator Kyrsten Sinema, Democrat of Arizona, and ensure passage of their Inflation Reduction Act, a wide-ranging climate, health care and tax bill.

An agreement reached last week between Senator Chuck Schumer, the majority leader, and Senator Joe Manchin III, Democrat of West Virginia, would have taken a small step in the direction of narrowing carried interest tax treatment. However, it would not have eliminated the loophole entirely and could still have allowed rich business executives to have smaller tax bills than their secretaries, a criticism lobbed by the investor Warren E. Buffett, who has long argued against the preferential tax treatment.

The fate of the provision was always in doubt given the Democrats’ slim control of the Senate. And Ms. Sinema had previously opposed a carried interest measure in a much larger bill called Build Back Better, which never secured the 50 Senate votes needed — Republicans have been unified in their opposition to any tax increases.

Had the legislation passed in the form that Mr. Schumer and Mr. Manchin presented it last week, the shrinking of the carried interest exception would have brought Democrats a tiny bit closer to realizing their vision of making the tax code more progressive.

What is carried interest?

Carried interest is the percentage of an investment’s gains that a private equity partner or hedge fund manager takes as compensation. At most private equity firms and hedge funds, the share of profits paid to managers is about 20 percent.

Under existing law, that money is taxed at a capital-gains rate of 20 percent for top earners. That’s about half the rate of the top individual income tax bracket, which is 37 percent.

The 2017 tax law passed by Republicans largely left the treatment of carried interest intact, after an intense business lobbying campaign, but did narrow the exemption by requiring private equity officials to hold their investments for at least three years before reaping preferential tax treatment on their carried interest income.

What would the Manchin-Schumer agreement have done?

The agreement between Mr. Manchin and Mr. Schumer would have further narrowed the exemption, in several ways. It would have extended that holding period to five years from three, while changing the way the period is calculated in hopes of reducing taxpayers’ ability to game the system and pay the lower 20 percent tax rate.

Senate Democrats say the changes would have raised an estimated $14 billion over a decade, by forcing more income to be taxed at higher individual income tax rates — and less at the preferential rate.

The longer holding period would have applied only to those who made $400,000 per year or more, in keeping with President Biden’s pledge not to raise taxes on those earning less than that amount.

The tax provision echoed a measure that was initially included in the climate and tax bill that House Democrats passed last year but that stalled in the Senate. The carried interest language was removed amid concern that Ms. Sinema, who opposed the measure, would block the overall legislation.

Why hasn’t the loophole been closed by now?

Many Democrats have tried for years to completely eliminate the tax benefits private equity partners enjoy. Democrats have sought to redefine the management fees they get from partnerships as “gross income,” just like any other kind of income, and to treat capital gains from partners’ investments as ordinary income.

Such a move was included in legislation proposed by House Democrats in 2015. The legislation would also have increased the penalties on investors who did not properly apply the proposed changes to their own tax filings.

The private equity industry has fought back hard, rejecting outright the basic concepts on which the proposed changes were based.

“No such loophole exists,” Steven B. Klinsky, the founder and chief executive of the private equity firm New Mountain Capital, wrote in an opinion article published in The New York Times in 2016. Mr. Klinsky said that when other taxes, including those levied by New York City and the state government, were accounted for, his effective tax rate was between 40 and 50 percent.

What would the change have meant for private equity?

The private equity industry has defended the tax treatment of carried interest, arguing that it creates incentives for entrepreneurship, healthy risk-taking and investment.

The American Investment Council, a lobbying group for the private equity industry, described the proposal as a blow to small business.

“Over 74 percent of private equity investment went to small businesses last year,” said Drew Maloney, chief executive of the council. “As small-business owners face rising costs and our economy faces serious headwinds, Washington should not move forward with a new tax on the private capital that is helping local employers survive and grow.”

The Managed Funds Association said the changes to the tax code would hurt those who invested on behalf of pension funds and university endowments.

“Current law recognizes the importance of long-term investment, but this proposal would punish entrepreneurs in investment partnerships by not affording them the benefit of long-term capital gains treatment,” said Bryan Corbett, the chief executive of the association.

“It is crucial Congress avoids proposals that harm the ability of pensions, foundations and endowments to benefit from high-value, long-term investments that create opportunity for millions of Americans.”

Jim Tankersley contributed reporting.

Read the full article here

A journalist since 1994, he also founded DMGlobal Marketing & Public Relations. Glover has an extensive list of clients including corporations, non-profits, government agencies, politics, business owners, PR firms, and attorneys.

Published

6 months agoon

August 17, 2025

(OKLAHOMA – August 17, 2025) – When I first started researching my family’s genealogy, I thought I was just going to fill in a few blanks.

Instead, I uncovered a lie so deep, so systematic, it reshaped everything I thought I knew about who we are as a people.

I want to show you something personal.

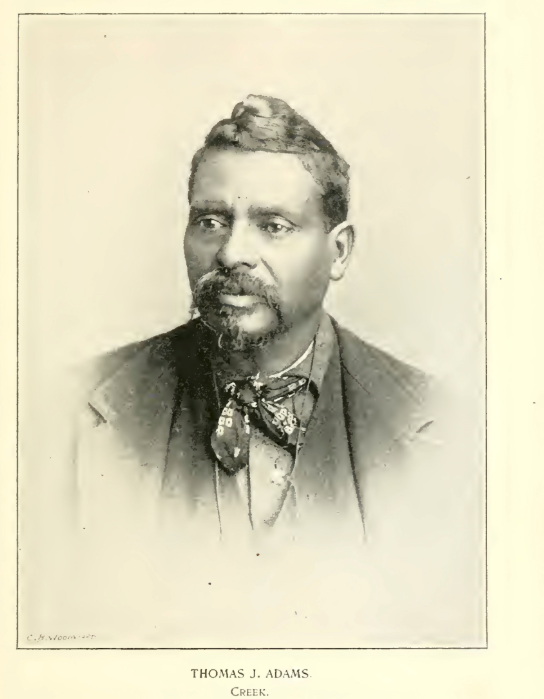

Below, you’ll see two official U.S. government records—both documenting one of my direct ancestors. Thomas Jefferson Adams Harjo.

Creek Nation certificate

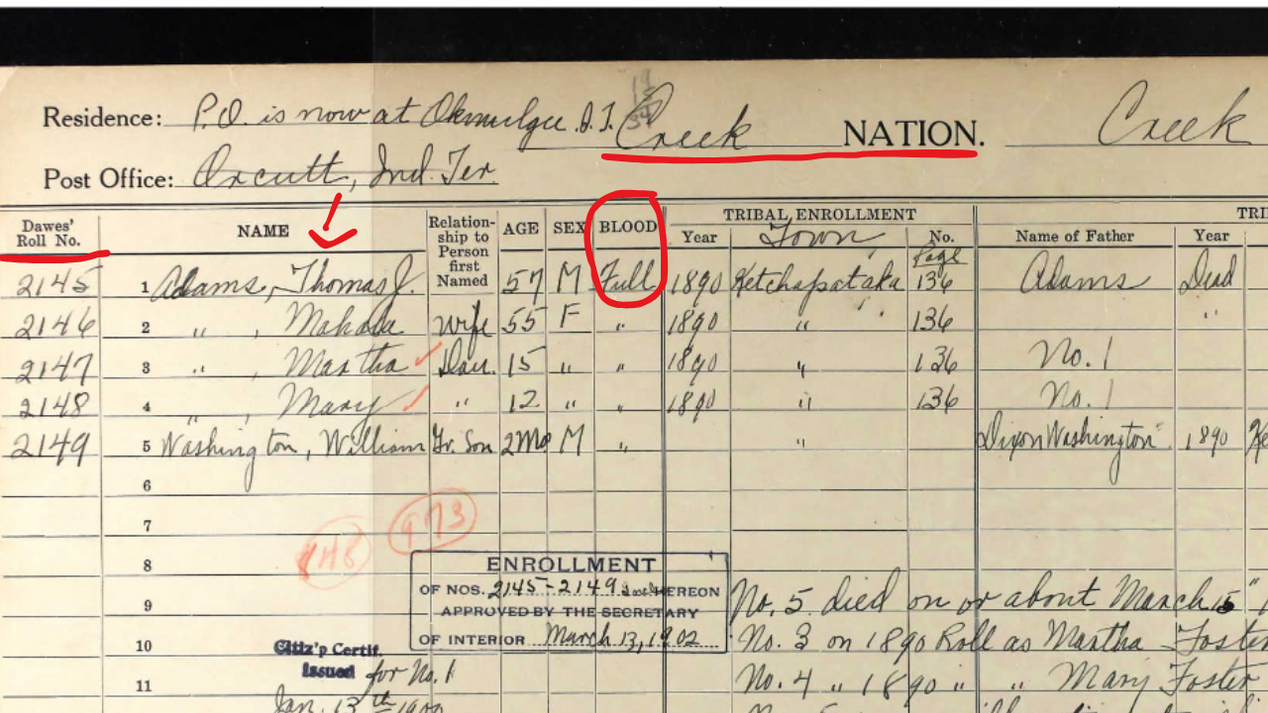

📜 The first is from the Dawes Roll, the federal list created in the early 1900s to register members of the Five Civilized Tribes.

As you’ll see, my ancestor is listed as a Full-Blood Indian—a clear acknowledgment of their tribal heritage and cultural identity.

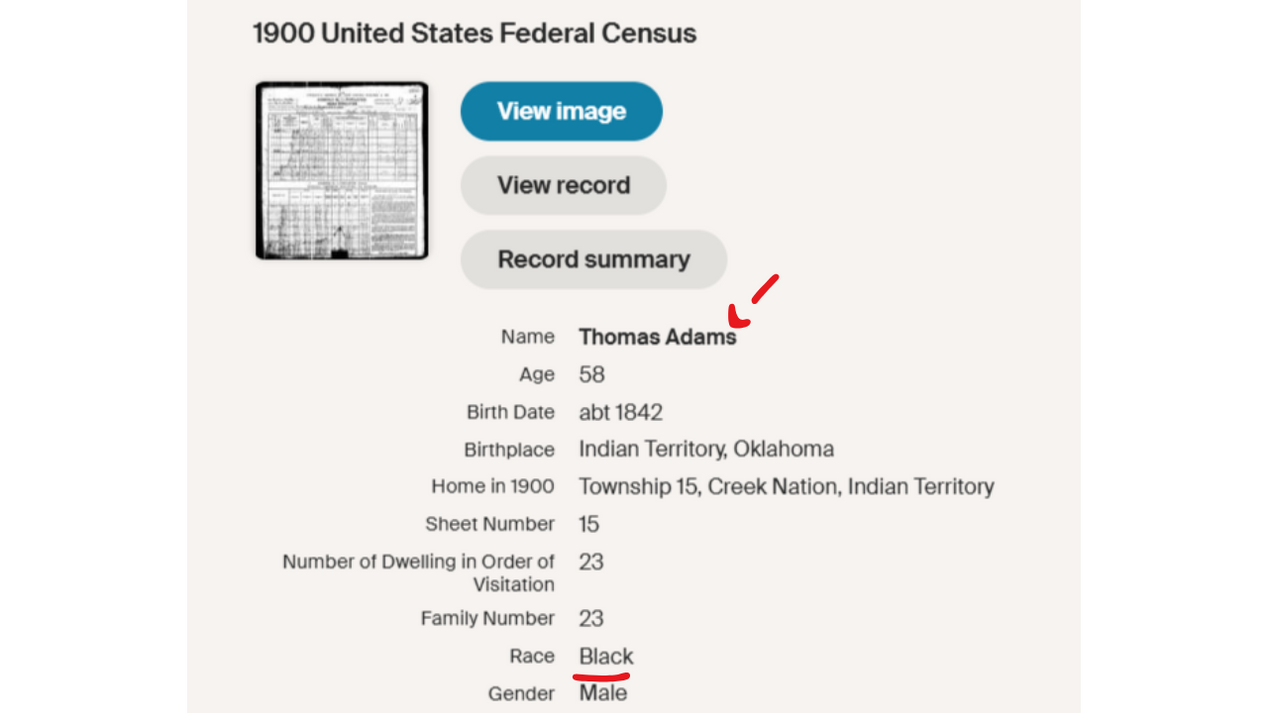

1900 US Census

But then, take a look at the second image:

📄 That’s the federal census record from just a few years later.

Same ancestor.

Same location.

But this time, the government marked them as Negro.

No tribe. No Indian classification.

Just folded into the general Black population—without consent, without explanation.

That wasn’t a mistake.

That was paper genocide.

This is what happened to millions of Indigenous Black Americans across the South.

Their identities were stripped away on paper—one document at a time—by a system designed to erase, absorb, and exploit.

This wasn’t just about racism. It was about land, power, and control.

By reclassifying tribal people as Negro or Colored, the government could:

Deny them land rights

Remove them from tribal rolls

Steal their inheritance

And make sure future generations never knew who they really were

This is why so many of our elders say, “My grandma said we had Indian in us.”

They weren’t lying.

They just didn’t have the tools to prove it.

Now we do.

And I’m not showing you this to just share my story—I’m showing you because this might be your story, too.

If you’re ready to go deeper, tomorrow I’m going to pull back the curtain on how far this went—how the reclassification of Black Indians was not an exception, but the rule across the Southeast.

You’re not crazy.

You’re not reaching.

You’re remembering.

—Mike

Founder, Native Black Ancestry

Published

6 months agoon

August 12, 2025

From a single Maryland facility to three locations and now two more opening in 2025, Dominique Dawes is scaling her gymnastics academy with a goal of 50 nationwide.

Her blend of elite training and a positive, family-focused culture is making waves in the $30 billion youth sports industry.

READ MORE

Published

6 months agoon

August 8, 2025

“Constructive Leadership Since 1926”

The Oldest Black Chamber in America. Period.

(DALLAS, TX – August 8, 2025) – When we talk about legacy, we start in Dallas.

Founded in 1926, the Dallas Black Chamber of Commerce (DBCC) stands as the first Black chamber of commerce in the United States. Nearly a century later, it remains a pillar of power, progress, and purpose—leading the charge for economic equity across North Texas.

With nearly 100 years of constructive leadership, the DBCC has been more than just an organization—it has been a movement. A movement rooted in advocacy, access, and accountability. Whether pushing policy, elevating Black entrepreneurs, or creating pipelines to capital and contracts, DBCC has consistently shown the nation what real Black business leadership looks like.

The Chamber’s mission is clear: To advocate for the creation, growth, and general welfare of Black-owned businesses and organizations across North Texas. Through strategic referrals, public-private partnerships, educational seminars, technical assistance, and marketing, the DBCC is building a thriving ecosystem for Black excellence.

Its core areas of impact include:

Economic Development

Education

Convention/Tourism

Special Projects & Initiatives

At the helm is President & CEO Harrison Blair, a third-generation community advocate whose leadership is deeply rooted in Dallas soil. The grandson of the legendary Bill Blair and son of Jordan Blair, Harrison continues the family’s commitment to uplifting the city through economic development, civic engagement, and business empowerment.

Under his leadership—and with Chairwoman Shenna Thomas and the Chamber’s dedicated board—DBCC continues to evolve as a force in local and statewide business circles. Blair also represents the Chamber on the North Texas Commission and the Texas Association of African American Chambers of Commerce, ensuring Black business has a seat at every major table.

What started in 1926 has now expanded into a robust engine for Black business across Dallas and beyond. Whether you’re an emerging entrepreneur or an established executive, DBCC offers the access, advocacy, and allyship needed to grow and thrive.

Because when Dallas moves, Black business moves.

And when Black business wins, Dallas wins.

🖥️ Learn more or become a member at dallasblackchamber.org

📍 North Texas and nationwide influence

📞 Contact: (214) 421-5200

Subscribe to our newsletter to get the latest news directly to your inbox.