(OKLAHOMA – August 17, 2025) – When I first started researching my family’s genealogy, I thought I was just going to fill in a few blanks.

Instead, I uncovered a lie so deep, so systematic, it reshaped everything I thought I knew about who we are as a people.

I want to show you something personal.

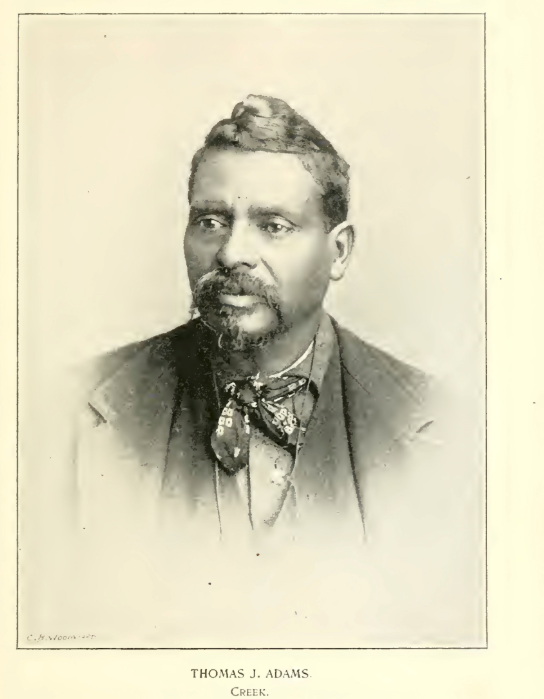

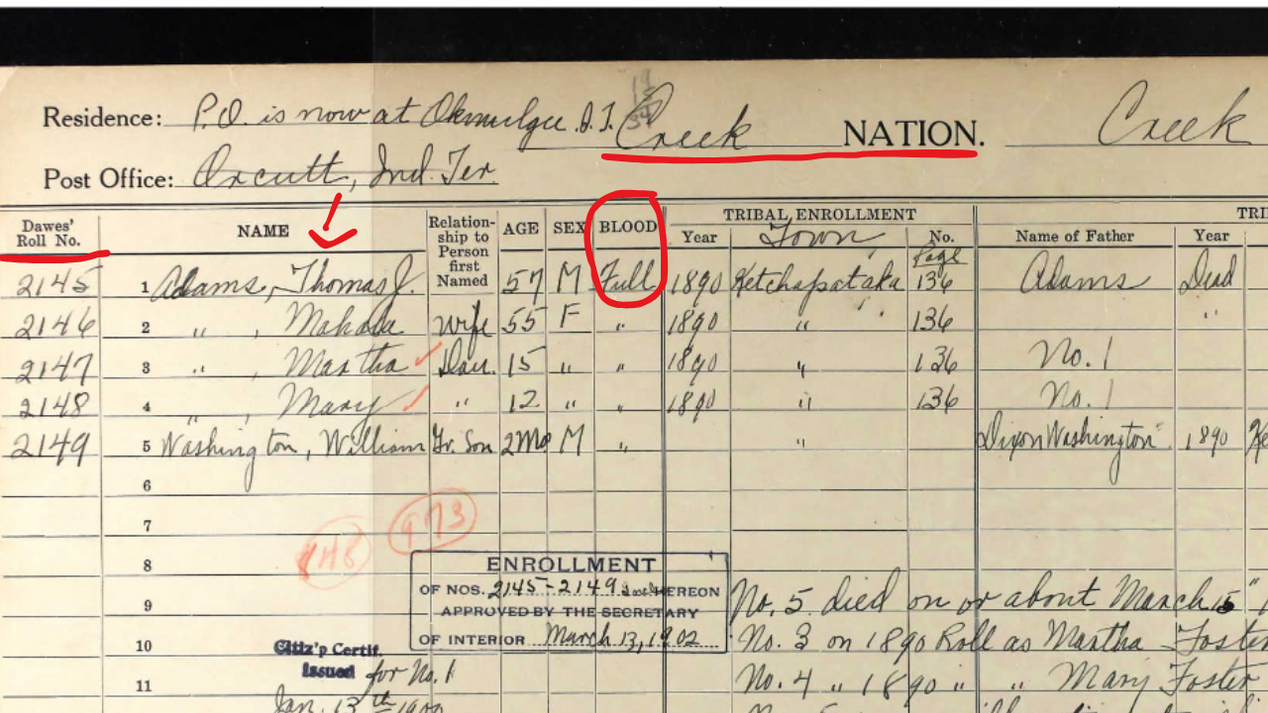

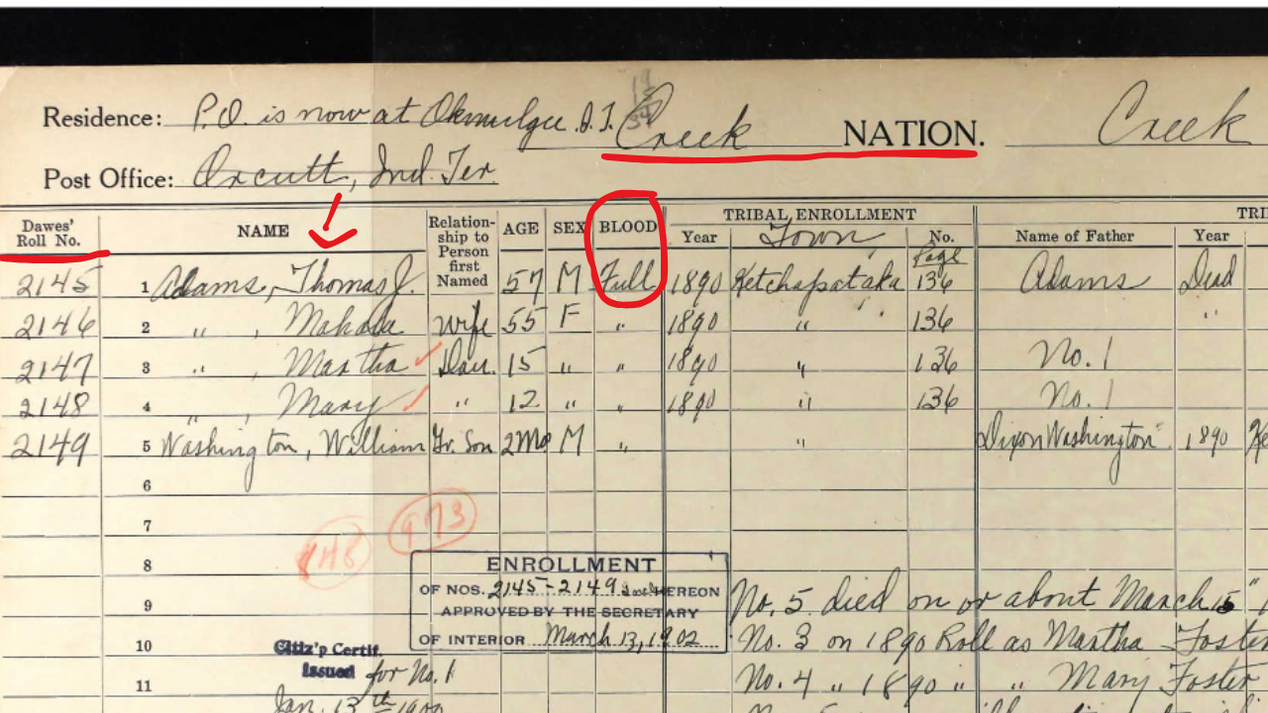

Below, you’ll see two official U.S. government records—both documenting one of my direct ancestors. Thomas Jefferson Adams Harjo.

Creek Nation certificate

📜 The first is from the Dawes Roll, the federal list created in the early 1900s to register members of the Five Civilized Tribes.

As you’ll see, my ancestor is listed as a Full-Blood Indian—a clear acknowledgment of their tribal heritage and cultural identity.

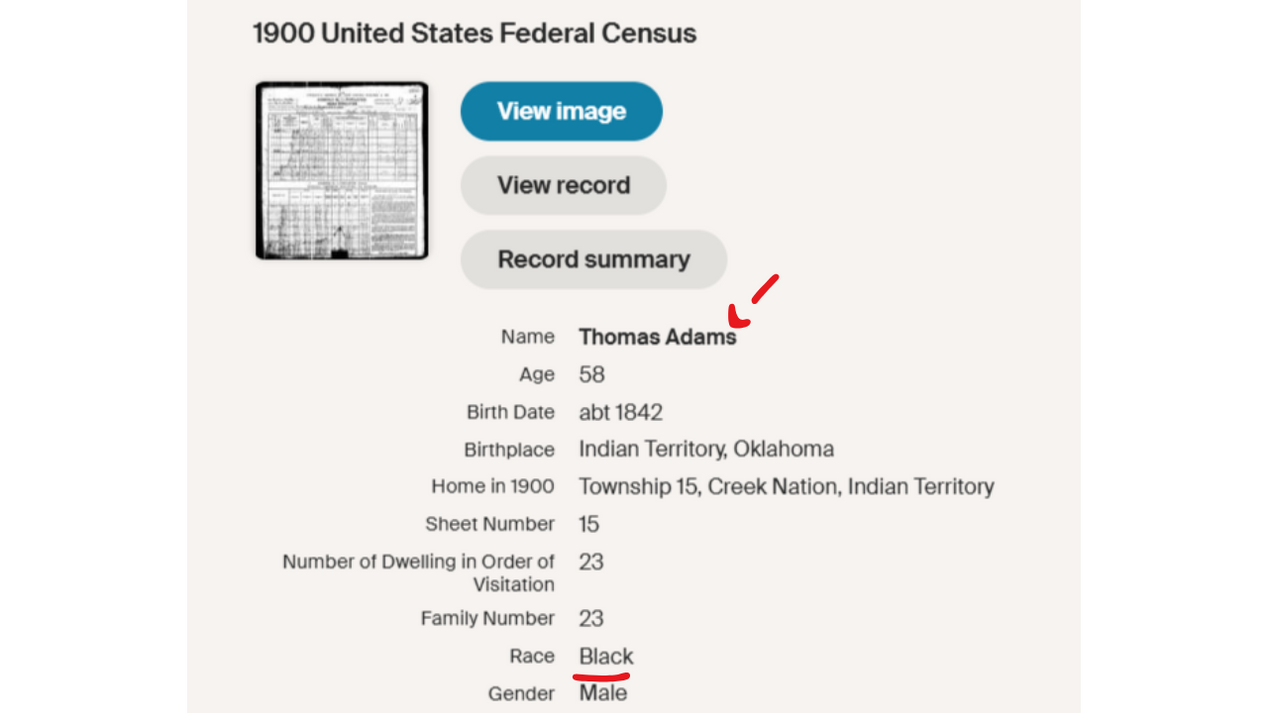

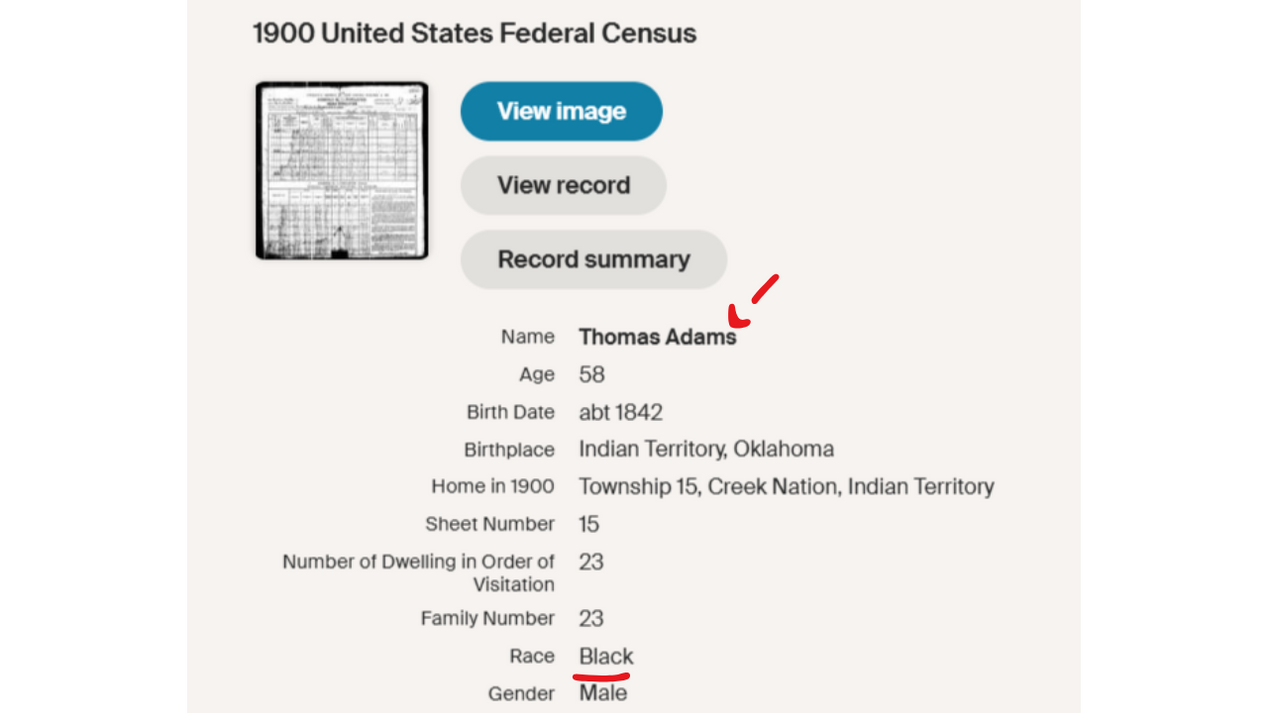

1900 US Census

But then, take a look at the second image:

📄 That’s the federal census record from just a few years later.

Same ancestor.

Same location.

But this time, the government marked them as Negro.

No tribe. No Indian classification.

Just folded into the general Black population—without consent, without explanation.

That wasn’t a mistake.

That was paper genocide.

This is what happened to millions of Indigenous Black Americans across the South.

Their identities were stripped away on paper—one document at a time—by a system designed to erase, absorb, and exploit.

This wasn’t just about racism. It was about land, power, and control.

By reclassifying tribal people as Negro or Colored, the government could:

This is why so many of our elders say, “My grandma said we had Indian in us.”

They weren’t lying.

They just didn’t have the tools to prove it.

Now we do.

And I’m not showing you this to just share my story—I’m showing you because this might be your story, too.

If you’re ready to go deeper, tomorrow I’m going to pull back the curtain on how far this went—how the reclassification of Black Indians was not an exception, but the rule across the Southeast.

You’re not crazy.

You’re not reaching.

You’re remembering.

—Mike

Founder, Native Black Ancestry

HBCU7 months ago

HBCU7 months ago

Videos3 years ago

Videos3 years ago

Videos3 years ago

Videos3 years ago

Videos2 years ago

Videos2 years ago

Videos3 years ago

Videos3 years ago

Videos1 year ago

Videos1 year ago

Videos3 years ago

Videos3 years ago

Videos3 years ago

Videos3 years ago